TESTAMENTARY TRUSTS

WHAT IS A TESTAMENTARY TRUST?

A good estate plan is all about getting the right assets to the right people at the right time. A testamentary trust can help with that.

A testamentary trust is a trust, similar to a family trust, but it is established by a will, and does not come into effect until the death of the willmaker.

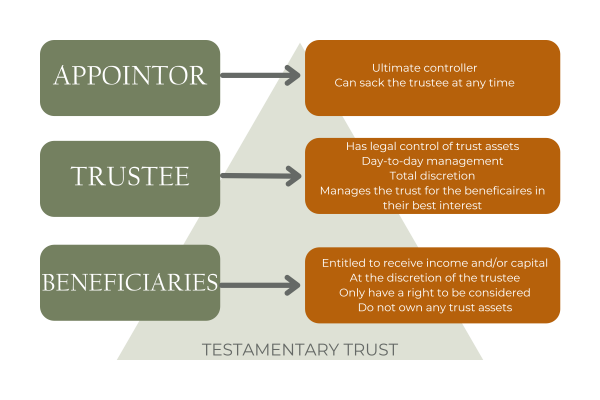

The assets of a trust are held and controlled by the trustee. The trustee is responsible for the day-to-day management of the trust and the due administration of the trust.

The beneficiaries are the people (or classes of people) who can potentially benefit from the assets of the trust.

There are several uses and benefits of a testamentary trust. Read on.

Provide a right of residence for a spouse

Balance secure housing for your spouse and your children’s future inheritance

Asset protection for your beneficiaries

Protect the inheritance of your beneficiaries

Asset protection from a spouse

Protection of your children’s future inheritance

Asset protection for your beneficiary’s children

Protect the inheritance of your beneficiary’s children

Asset protection for your beneficiaries

Protect the inheritance of your beneficiaries

Tax benefits for your beneficiaries

A testamentary trust can be a powerful income tax environment

Tax benefits for your beneficiaries

A testamentary trust can be a powerful income tax environment

Inheritance protection for your beneficiaries

Protect the inheritance from the beneficiaries themselves

Financial controller of your choice for minors

A financial controller of your choice for minors

A testamentary trust is a trust established by a will that does not come into effect until the death of the willmaker. The terms of the trust are contained in the will.

A trustee:

- has control of the assets of the trust

- is the legal holder of the assets

- is responsible for the day-to-day management of the trust and the due administration of the trust

Anyone over the age of 18 years can be a trustee of a testamentary trust.

Sometimes, the trustees of the testamentary trust are the same as the executors.

For testamentary trusts established for adult children, usually each child is the trustee of the trust of which they are the primary beneficiary.

If the testamentary trust is for protection from family law proceedings, the trust should have the adult child as a trustee, and a co-trustee.

Sometimes, it is appropriate to appoint an independent trustee of a testamentary trust because the purpose of the trust is to protect the assets for the future beneficiaries.

A testamentary trust should have many people who can potentially benefit from the assets of the trusts – these people are the “beneficiaries” of the trust

For a nuclear family, usually your surviving spouse and/or minor children are the primary beneficiaries, plus a number of other classes of beneficiaries who may benefit from the trust.

If you are concerned your spouse may re-partner, or you have a blended family, or your spouse is elderly, your surviving spouse can be a lifetime beneficiary, or income-only beneficiary, or have a right of residence of trust real estate. This enables you to provide income and a right of residence for your surviving spouse during their lifetime, whilst preserving the capital for your children as future beneficiaries.

If testamentary trusts are established for adult children, the beneficiaries of each trust are usually each adult child, their children and their grandchildren, plus a number of other classes of beneficiaries who may benefit from the trust. This enables each adult child to distribute income from the trust to their minor children for their living and educational expenses, and adult children or their spouse, who have low incomes, reducing the overall tax payable for each adult child’s family as a unit.

You should consider whether incorporating a testamentary trust in your will is appropriate in your particular circumstances.

Each testamentary trust must lodge a tax return every year so there will be accountant’s fees to consider. A financial planner may also be required to provide periodic financial advice to the trustee.

You will need to weigh up the costs associated with the ongoing administration of the testamentary trust with the following:-

- the likely value of your estate (noting that superannuation death insurance benefits and life insurance benefits may be significant);

- the nature of your estate assets and whether they are likely to generate income to justify the ongoing administration expenses;

- the risk profile of each beneficiary may justify the inclusion of testamentary trusts for asset protection purposes; or

- your desire to protect the inheritance of a particular beneficiary – for example, a beneficiary with special needs (consider also a special disability trust), a beneficiary with addiction issues or a beneficiary with the inability to manage money.

Usually, if you have assets of $500,000 or more, including superannuation death benefits and life insurance, it is viable to consider incorporating a testamentary trust in your will.

It is always recommended that you consult your accountant and/or financial planner in relation to financial matters. We are happy to collaborate with your accountant and/or financial planner to ensure the best solutions are provided in your estate plan.

None of the beneficiaries own the trust assets and their only right is to be considered by the trustee. This is because of the discretionary nature of the trust and what makes the trust so powerful for assets protection.

Yes, a trustee can also be one of the beneficiaries of the trust.

Most often when there are multiple testamentary trusts in the one will, each beneficiary is the trustee of ‘their’ trust and they choose themselves or their family members to benefit from the trust.

Testamentary trusts offer a number of tax benefits.

Income earned each year from investing the trust assets are distributed to the beneficiaries, and each beneficiary is taxed on the income received from the trust at their own marginal tax rate.

Each year, the trustee can choose which of the beneficiaries should receive the income earned by the trust – this enables the trustee to give income to beneficiaries who have lower tax rates.

One of the best tax benefits of a testamentary trust is their treatment of income paid to minors. Beneficiaries under the age of 18 are treated like adults for tax purposes which means that each minor can receive around $20,000 each year from the trust income, tax free.